- Market Overview

- Futures

- Options

- Custom Charts

- Spread Charts

- Market Heat Maps

- Historical Data

- Stocks

- Real-Time Markets

- Site Register

- Mobile Website

- Trading Calendar

- Futures 101

- Commodity Symbols

- Real-Time Quotes

- CME Resource Center

- Farmer's Almanac

- USDA Reports

Income for Life: 3 Dividend Stocks Crushing the S&P 500

Dividend stocks aren’t typically as affected by broad market volatility. Sure, they might follow similar patterns, but for the most part, they don’t tend to swing quite as wildly. Part of the reason for this is that investors who hold dividend stocks usually do so for the long term.

The result? Dividend stocks tend to lag the S&P 500. Notice I said “tend”? I said that becuase, as someone who dislikes absoluteness of any kind, I'm always out there looking for ways to buck the trend. And today, I found a handful of Dividend Kings - companies that have increased dividends for 50 or more straight years - that have outperformed the S&P 500 this year. Today, let’s have a look and see if they deserve a spot in your income portfolio.

How I Came Up With The Following Stocks

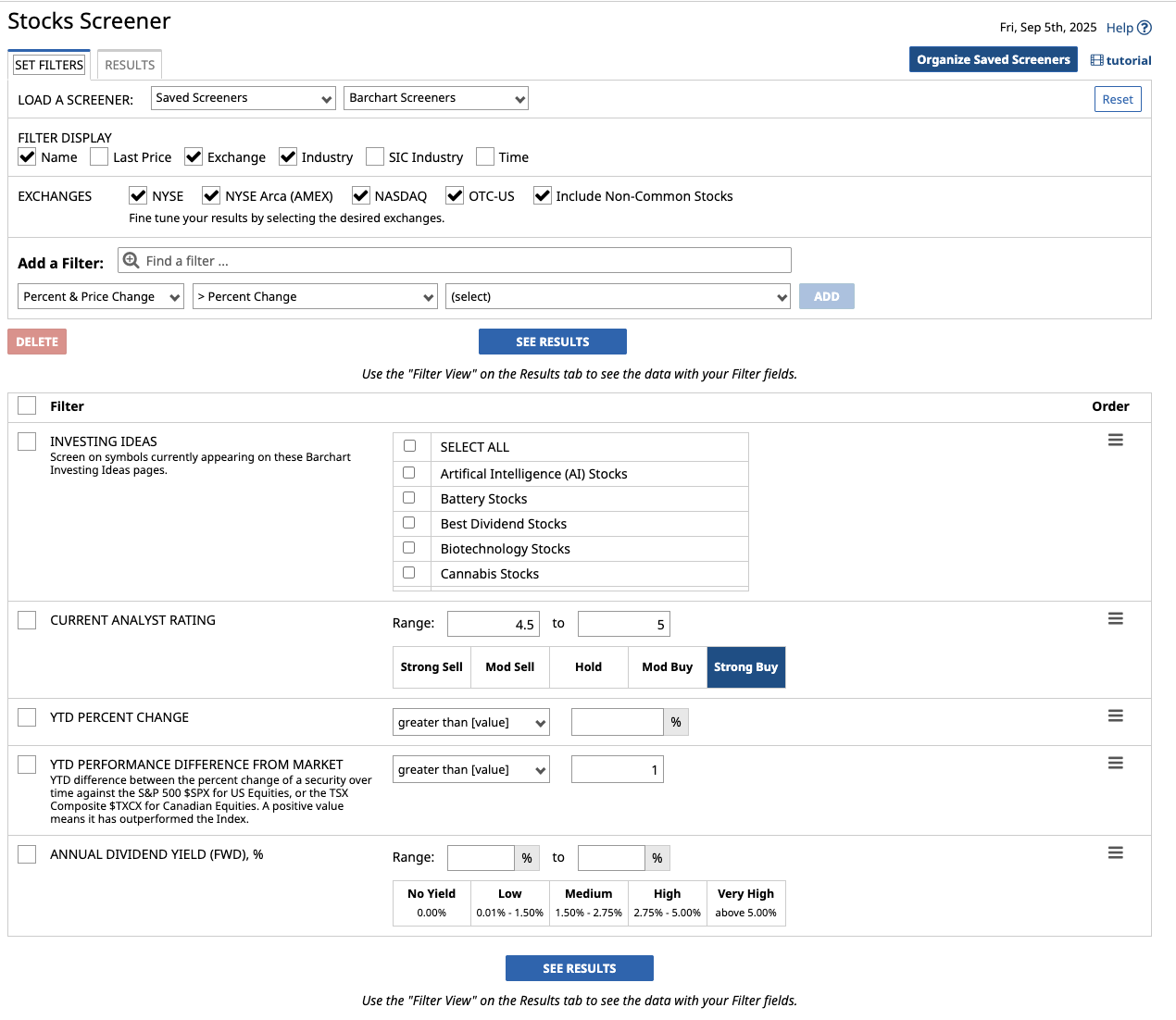

From Barchart’s Stock Screener tool, I searched for the following filters:

- Investing Ideas: Dividend Kings.

- Current Analyst Rating: 4.5 to 5 (Strong Buy). The results should be top-shelf Dividend Kings, at least according to Wall Street.

- Annual Dividend Yield (Forward): Left blank, so I can arrange the results based on it.

- YTD Performance Difference From Market: 1% or more. This filter, meanwhile, limits the results to companies that have outperformed the S&P 500 by at least 1%. By the way, the values shown here represent the absolute difference in performance, not the percentage ratio.

- YTD Percent Change: 1% or more. This filter limits the results to stocks that have had positive performance on a year-to-date basis.

With these filters, I got exactly three companies, which I then arranged from highest to lowest yield. So let’s get started with the top one.

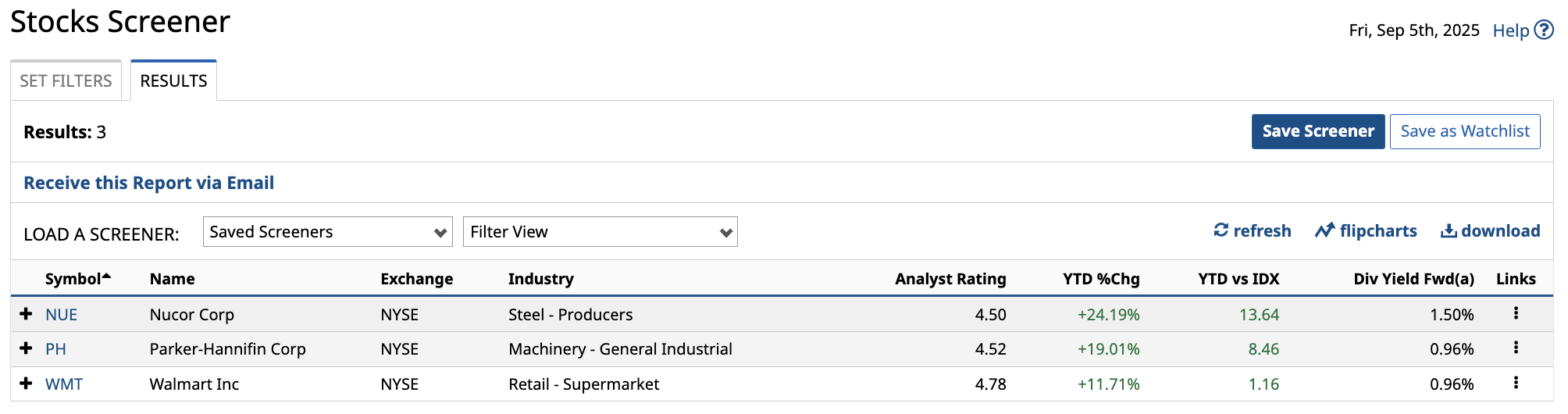

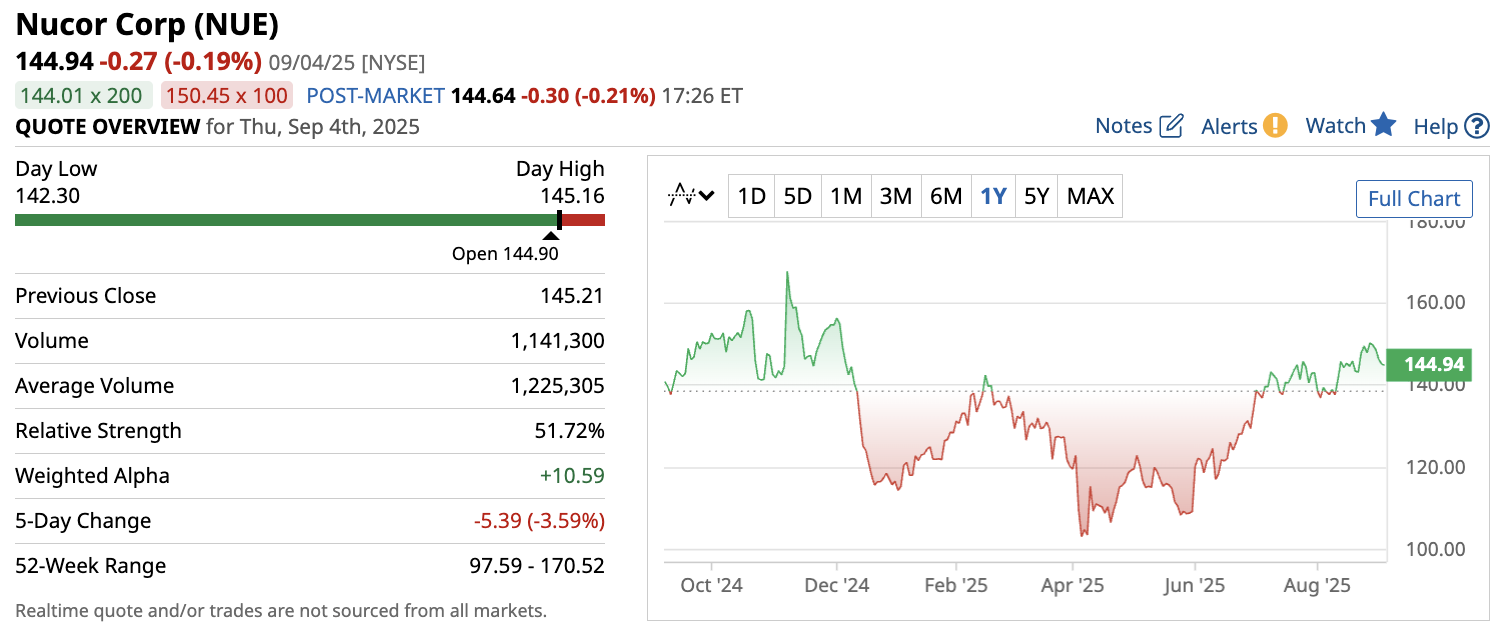

Nucor Corp (NUE)

Kicking off my list is Nucor Corporation, North America’s largest steel manufacturer and recycler. The company operates 26 steel mills and over 100 steel fabrication centers in the U.S., while also boasting the largest recycling operations in North America - not just out of all steel recyclers, but out of all recyclers.

But that’s not why we’re talking about Nucor today. Performance-wise, the stock has increased by 24.19% year-to-date, beating the S&P 500 by 13.64 percentage points.

Meanwhile, the company has increased dividends for 52 straight years. Today, the company pays 55 cents quarterly, which works out to $2.20 per year and translates to a 1.5% yield. A quick look at its dividend metrics, and we can see Nucor maintains a solid 35.80% dividend payout ratio, giving it a lot of headroom to increase the payout in the near future.

And, of course, NUE stock enjoys a strong buy rating from analysts, with an average score of 4.50.

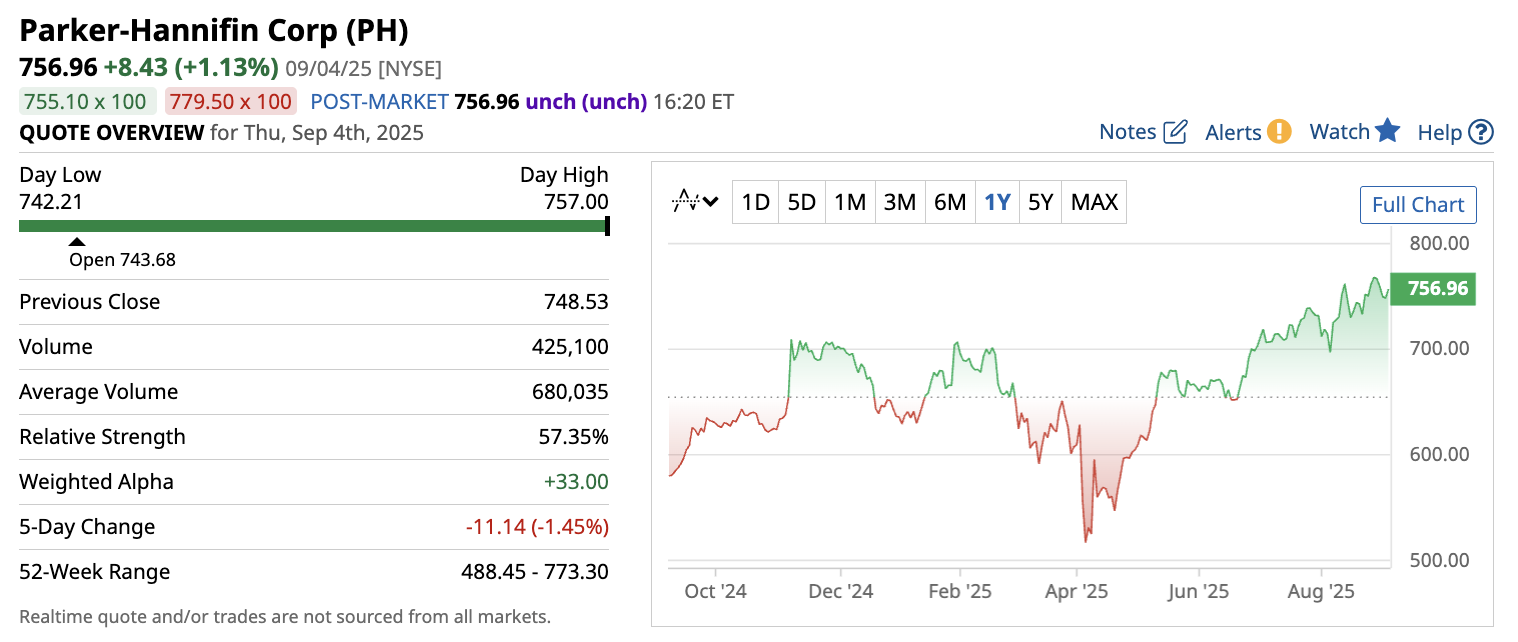

Parker-Hannifin Corp (PH)

Next up is Parker-Hannifin Corporation, or usually just Parker for short. Parker is a top engineering firm and a global leader in motion and control technologies. Think hydraulic systems, pneumatics, adhesives and protective coatings, fluid and filtration systems, and aerospace components. Its products are used in everything from factories and underwater drilling stations to medical devices and space stations.

Parker-Hannifin is the second-best performer on this list, with a 19.01% year-to-date return, outperforming the S&P 500 by 8.46 percentage points.

It is also the second-highest in terms of yield, though only at 0.94% based on a $1.80 quarterly payout. However, the company has maintained a 69-year-long streak of dividend increases, so its real strength lies in reliability and consistency, not yield numbers.

Besides, analysts seem quite bullish with PH stock, rating it a strong buy with a 4.52 average score.

Walmart Inc (WMT)

The last company on my list of Dividend Kings is retail giant Walmart Inc., a once modest brick-and-mortar retailer that has evolved into one of the world's largest omni-channel retailers. Walmart receives over 255 million customer visits across its 10,797 physical stores and online portals each week. So there’s no shortage in reach, which makes the company the formidable go-to retailer it is today.

WMT stock has grown 11.71% year-to-date, 1.16 percentage points away from the S&P 500’s performance over the same period. It might look small, but a win is a win.

As of 2025, Walmart has increased its dividends for 52 consecutive years. Currently, the company pays 23.50 cents quarterly, or 94 cents per year, which translates to around a 0.93% forward yield. So far, that’s the lowest yield on this list.

However, WMT stock makes up for it with a strong buy rating and an average score of 4.78 - the highest on this list.

Final Thoughts

These Dividend Kings have proven themselves to beat the market. What more can we expect in the next twelve months, with analysts expecting even more growth?

That said, long-term dividend investing isn’t all about riding the highs. Even if the next year looks absolutely rosy for the companies on this list, don't let your guard down. Always monitor your positions and the news for further developments. Remember, suggestions can be found everywhere, but your own due diligence should never be overlooked.

On the date of publication, Rick Orford did not have (either directly or indirectly) positions in any of the securities mentioned in this article. All information and data in this article is solely for informational purposes. For more information please view the Barchart Disclosure Policy here.